Have you noticed how quickly money moves in today’s world? In financial markets, even a few seconds can be the difference between making a million dollars and losing one. This constant speed means that human traders and analysts can no longer process enough data fast enough to keep up. They simply cannot read and analyze millions of data points across global markets all at once.

This is the core challenge that Artificial Intelligence solves. AI has quickly become a critical tool for financial institutions, extending far beyond simple calculators to manage high-stakes decisions, detect fraud, and optimize huge financial portfolios. The industry needs powerful, bespoke systems to handle its speed and complexity. That is why the future of finance relies on Custom AI solutions built specifically for these unique markets.

Algorithmic trading, often called algo-trading, uses complicated computer programs to buy and sell stocks and bonds at the best possible times and prices. These algorithms look at huge amounts of data, including market trends, past records, and even social media chatter, to make quick decisions.

The biggest benefit of this system is speed. Traditional trading needs human input, which is slow and prone to mistakes. In contrast, algorithms can execute trades in milliseconds, capturing fleeting market chances that no human trader could ever catch. This speed not only makes trading more efficient but significantly cuts down on transaction costs for large banks.

Furthermore, algorithms are designed to follow specific rules without emotion, making sure every trade is executed with a high level of accuracy. This precision minimizes the risk of human errors, which are incredibly costly in the fast-paced world of financial markets. The ability to handle massive volumes of transactions at scale is a huge advantage for global banks managing extensive portfolios.

While algorithmic trading is the most famous application, AI’s power extends far beyond buying and selling. It is changing critical areas like risk management, fraud detection, and customer personalization.

Risk management is vital for financial health. Machine learning programs can analyze years of historical data to spot patterns and predict potential financial risks before they even happen. This predictive capability allows institutions to take quick, proactive steps to prevent losses.

AI is also winning the battle against fraud. Financial crime is a growing concern, and traditional methods struggle to keep up with sophisticated tactics. AI systems track transaction patterns in real-time, instantly spotting weird activities that may signal fraud. Because these systems learn from every fraud attempt, they constantly improve their detection skills. When companies need a long-term plan for managing these complex systems, they look for comprehensive ai development services that guarantee stability and continuous support.

A compelling example of this technology in action can be seen at Goldman Sachs, a global investment bank. They use AI to improve their trading strategies and operations. Their AI-driven programs optimize trading by analyzing vast datasets to find opportunities that human traders might overlook, significantly boosting their performance and reducing operational costs.

Beyond trading, Goldman Sachs uses AI for risk management. Their systems analyze data to predict risks and assess market conditions. During periods when the market is unstable, these AI systems can adjust trading plans in real-time to minimize potential losses.

This entire planning and system design process is complex. Financial institutions often engage generative ai consulting services right at the beginning to map out these transformation projects, ensuring the integration of advanced LLM and generative models is stable, compliant, and focused on high-value results.

The integration of AI into financial markets is a profound advancement for the sector. The benefits of speed, accuracy, and scalability are revolutionizing everything from trade execution to risk assessment. If your firm is ready to modernize its risk strategy and seize new market opportunities, you need a partner who understands the technology and the high financial stakes.

We ensure your system is accurate, secure, and ready to meet the highest demands of the financial sector. Ready to modernize your lending strategy and reduce default rates? Then why miss the chance to entertain with our free AI Consulting Services!

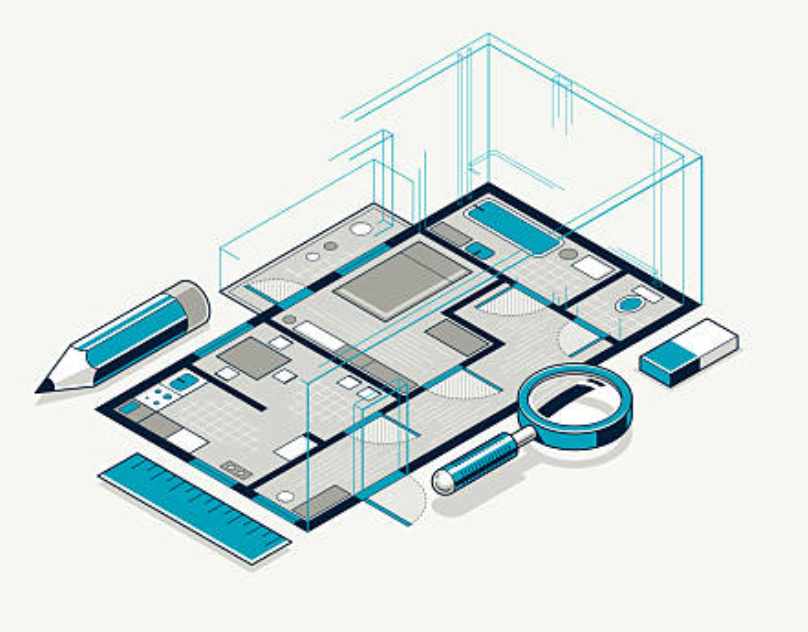

Unlock PropTech automation. Learn how our custom AI uses Computer Vision and geometric reasoning to extract data from floor plans, reducing costs.

.png)

Automate grading, curriculum mapping, and student records. See 5 top use cases where IDP and OCR transform academic operations.

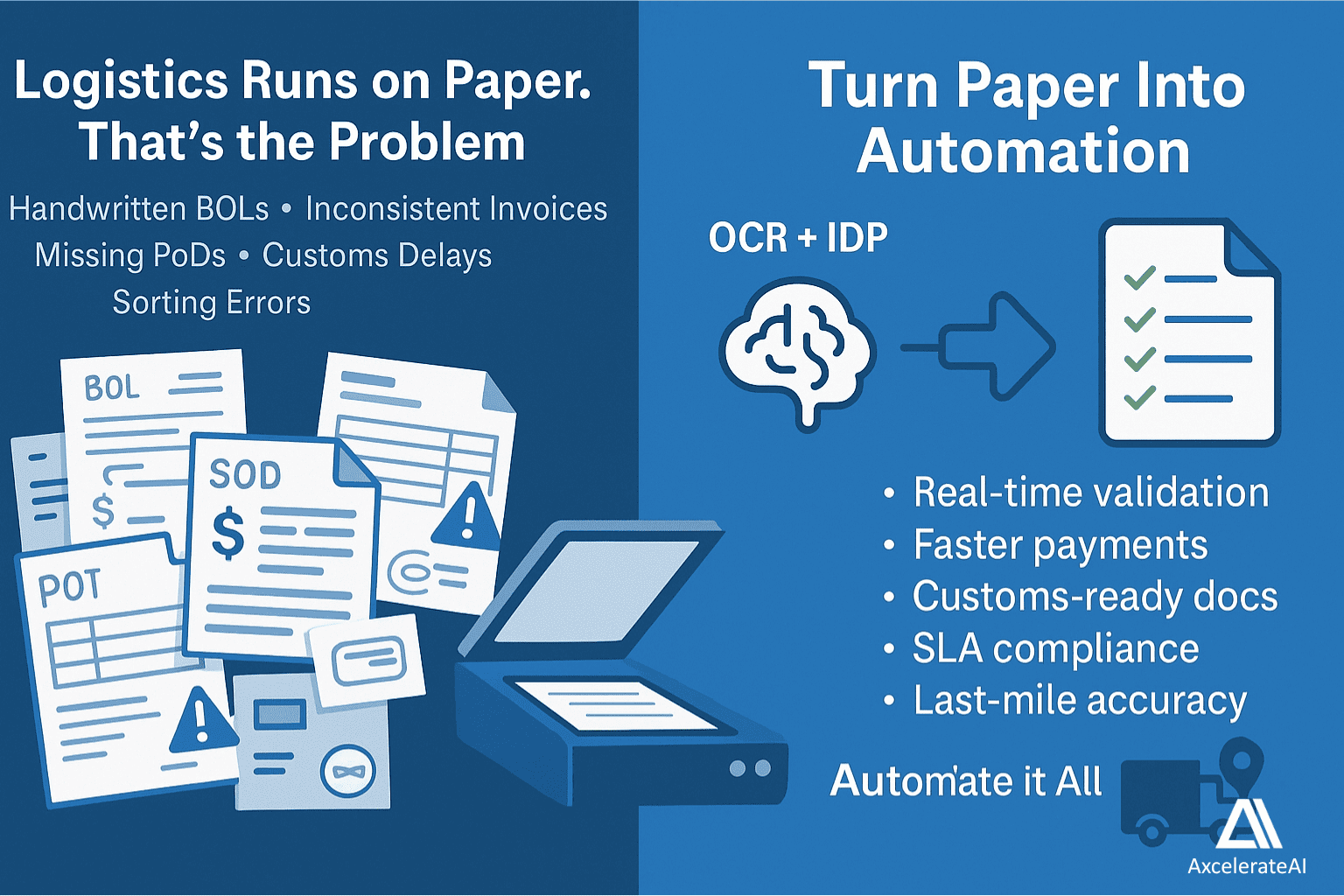

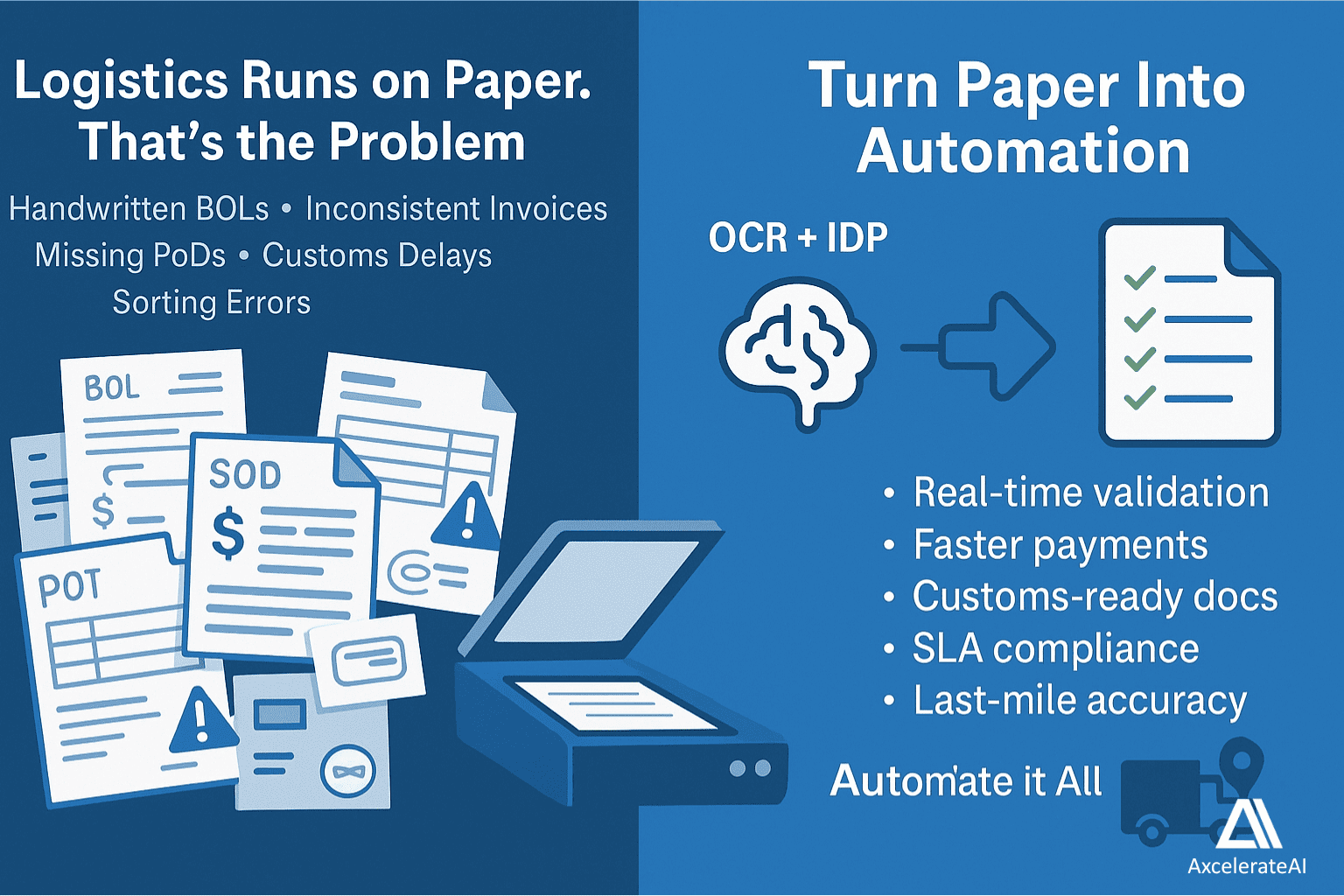

Unlock logistics efficiency with OCR and IDP: Automate inventory, supply chain tracking, and compliance. See real examples from DHL and Maersk.

Unlock PropTech automation. Learn how our custom AI uses Computer Vision and geometric reasoning to extract data from floor plans, reducing costs.

.png)

Automate grading, curriculum mapping, and student records. See 5 top use cases where IDP and OCR transform academic operations.

Unlock logistics efficiency with OCR and IDP: Automate inventory, supply chain tracking, and compliance. See real examples from DHL and Maersk.